As marketplace enrollment continues to climb and concurrent risk adjustment gains traction, health plans must find innovative ways to improve financial and clinical outcomes. Adopting automated coding and analytics processes at scale will enable Affordable Care Act (ACA) and Medicaid plans alike to better understand the health of their populations, engage members more effectively, and keep pace with a rapidly changing health care environment

ACA enrollment has skyrocketed to record levels yet again in 2022. While this is a huge win for the Biden Administration’s efforts to expand access to affordable care, managing the needs of such a large, diverse population is no easy task. Given the unique challenges ACA plans face, embracing strategies such as automation and advanced analytics will be much more effective than attempting to retrofit Medicaid Part C risk adjustment strategies. As the Centers for Medicare & Medicaid Services (CMS) pivot toward a concurrent risk model, implementing a technology-driven approach can also benefit Medicaid plans as well, allowing them to perform targeted member interventions, expand access and equity, and improve financial and clinical outcomes.

Understanding the ACA risk adjustment landscape

ACA plans experience an incredibly high member turnover rate of 40 percent. According to 2021 data, even Medicaid plans see nearly 25 percent of adult beneficiaries change plans within one year. What this means is that plans have a blank data slate for much of their population each year, making it difficult to get an accurate picture of risk. Adding to this complexity, the concurrent risk adjustment model ACAs operate under relies solely on data submitted the year it occurred—a much shorter timeline than the year and a half Medicare plans have to submit documentation.

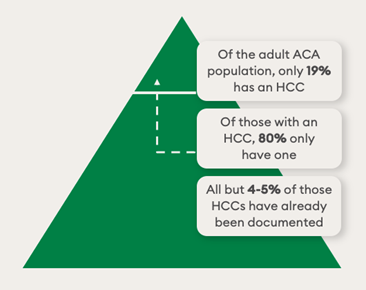

On the plus side, ACA beneficiaries are relatively healthier than those under Medicare and Medicaid. In fact, just 19 percent of the adult ACA population has at least one risk-adjusted condition and around 95 percent of these codes are captured through claims. However, locating the remaining 5 percent can be like trying to find a (very valuable) needle in a haystack. If you consider the fact that a 1 percent improvement in accuracy can yield a 20 percent increase in per chart value, it's clear just how critical it is to improve coding accuracy. This can be a daunting task for such a complex patient population, but ACA plans don’t need to review every single claim on their own. Instead, they can partner with an expert coding vendor that can run suspecting algorithms to identify medical records that warrant additional evaluation. These records are assessed during a coding review, which can be done either internally or by their vendor partner.

Improve coding accuracy with a performance assessment

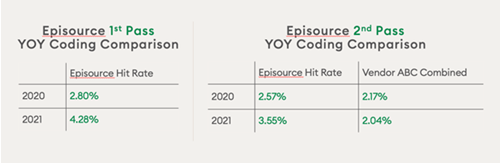

To improve accuracy over time, plans must be able to execute a repeatable coding review process. Episource partnered with a large, national health plan that operates under the ACA model. They conduct a monthly assessment of coding vendor performance on first- and second-level reviews. Through these assessments, the plan discovered that some vendors can only find easier-to-identify conditions, such as diabetes without complications, while others excel at rooting out the difficult-to-find HCCs, such as cancer or hemophilia. By communicating these strengths and weaknesses to their vendors, the plan has been able to help them fine-tune their processes and, ultimately, increase coding accuracy.

In the case of Episource, this approach has been highly successful. After providing feedback to help train our NLP engine and expert human coders, the plan saw Episource’s year-over-year hit rate (the find rate of a unique condition) for first and second pass reviews improve 1.48 percent and 0.98 percent respectively. Health plans that implement similar types of assessments can effectively get much more out of their vendor relationships and coding programs overall.

Turn insights into action: The power of advanced analytics

As we’ve outlined above, coding accuracy is critical—but it is the analysis of that data that enables plans to take decisive action and improve care for their members. An expert risk adjustment vendor can (and should) be very helpful in this regard. They can work with plans to highlight successes and unearth opportunities, identify themes and trends in data, provide tactical recommendations, and measure program impact to fulfill strategic goals.

Here are four examples of how coding insights can be turned into action:

- Identify the prevalence of diagnoses using benchmarking: During one second-level review, Episource applied its advanced NLP coding engine to resurface a higher prevalence of hard-to-locate diagnoses codes, such as mental disorders and diabetes with complications. This information can be used to create targeted clinical interventions and improve the coordination of downstream care for higher-risk populations.

- Implement targeted chart retrieval: As such a small percentage of beneficiaries that have an HCC, stratifying chase lists is critical for ACA plans. If you set your list too broad, you may not be targeting the right population segments. Too narrow, and you could fail to identify conditions and make the appropriate interventions. Using a machine learning system can help automate the review and analysis of claims and prioritize chart chases based on the likelihood of finding an HCC.

- Validate compliance issues and identify invalid codes: Many complex HCC codes tend to be non-compliant or not fully supported by documentation. Therefore, plans can leverage analytics services that look for coding adds and deletes before final submission to ensure accuracy and compliance. As the number of RADV and other regulatory audits increase, evaluating codes with a compliance lens will become increasingly important.

- Develop a strategy to capture clinical indicators: When medical record data points to a certain diagnosis but it is not confirmed by the claim, plans can work with retrospective coding reviewers to improve how clinical indicators are captured and processed. One way to do this would be to share clinical indicator data with your analytics team and request additional charts for review to determine if the provider documented evidence in the chart without transferring it to the claim. Plans can also ask providers to confirm or deny a condition and even request they bring in the patient for an assessment.

Implementing these strategies can take time, but ACA plans can pursue a retrospective concurrent review by analyzing claims and selecting charts for coding throughout the year. In this way, they can make adjustments to documentation earlier in the risk adjustment process and improve HCC capture before final submission.

Pulling it all together: Analysis at work

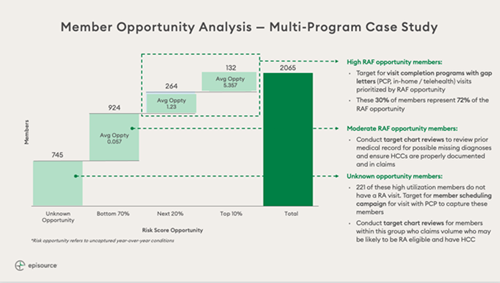

To see how this all fits together, let's look at a multi-program example where Episource worked with payer clients to identify member opportunities based on risk adjustment factor (RAF) scores. To begin, we aggregated data from multiple sources and ran it through our analytics platform to compare current performance against past performance and peer benchmarks. With this analysis, we divided members into three categories of risk with tailored recommendations for each. For example, for members with high RAF opportunity and low visit completions, we suggested conducting in-home assessments and telehealth visits. By properly stratifying members into their respective categories, Episource helped health plans target the right members with the right interventions, making that needle in the haystack much easier to find.

About the author

Andrew Perlstein, senior vice president, customer success, is responsible for Episource's client services division and ensures that client organizations derive maximum value from their Episource partnerships. He has over 15 years of client relations experience in the health care industry and has held a variety of leadership roles with McKesson Corporation, RelayHealth, and the Advisory Board Company. Perlstein earned his Bachelor's degree in political science and Spanish from Duke University.