In an HPMS memo released late Thursday, the Medicare Drug & Health Plan Contract Administration Group announced updates to 2025 agent and broker compensation rates and submissions.

Earlier this month, U.S. District Judge Reed O’Connor of the Northern District of Texas Fort Worth Division placed a stay on the Centers for Medicare & Medicaid Services’ (CMS) plans to cap administrative payments and restrict contract terms.

RELATED: Fed judge pauses CMS caps to MA brokers, agents pay

CMS wanted to crack down on bonuses that some insurers offered to brokers or agents to steer consumers to their plans even if they didn’t meet the individuals’ needs. But Americans for Beneficiary Choice, Council for Medicare Choice, Senior Security Benefits, LLC, Fort Worth Association of Health Underwriters, Inc., and Vogue Insurance Agency argued in a lawsuit that the caps and contract restrictions are arbitrary and capricious, failed to substantiate key parts of the final rule, did not sufficiently address reliance interests, did not provide fair notice of what was prohibited in contract-terms restrictions, did not sufficiently respond to public comments, and the agency did not adequately explain how and why it reached the fixed fee amount.

RELATED: 2025 Medicare Advantage Final Rule is out: 10 things to know about the changes

Kathryn A. Coleman, director of CMS’ Medicare Drug & Health Plan Contract Administration Group, wrote in the memo that the regulatory language effective prior to the 2025 final rule will be in effect during the court-ordered stay. The updates state:

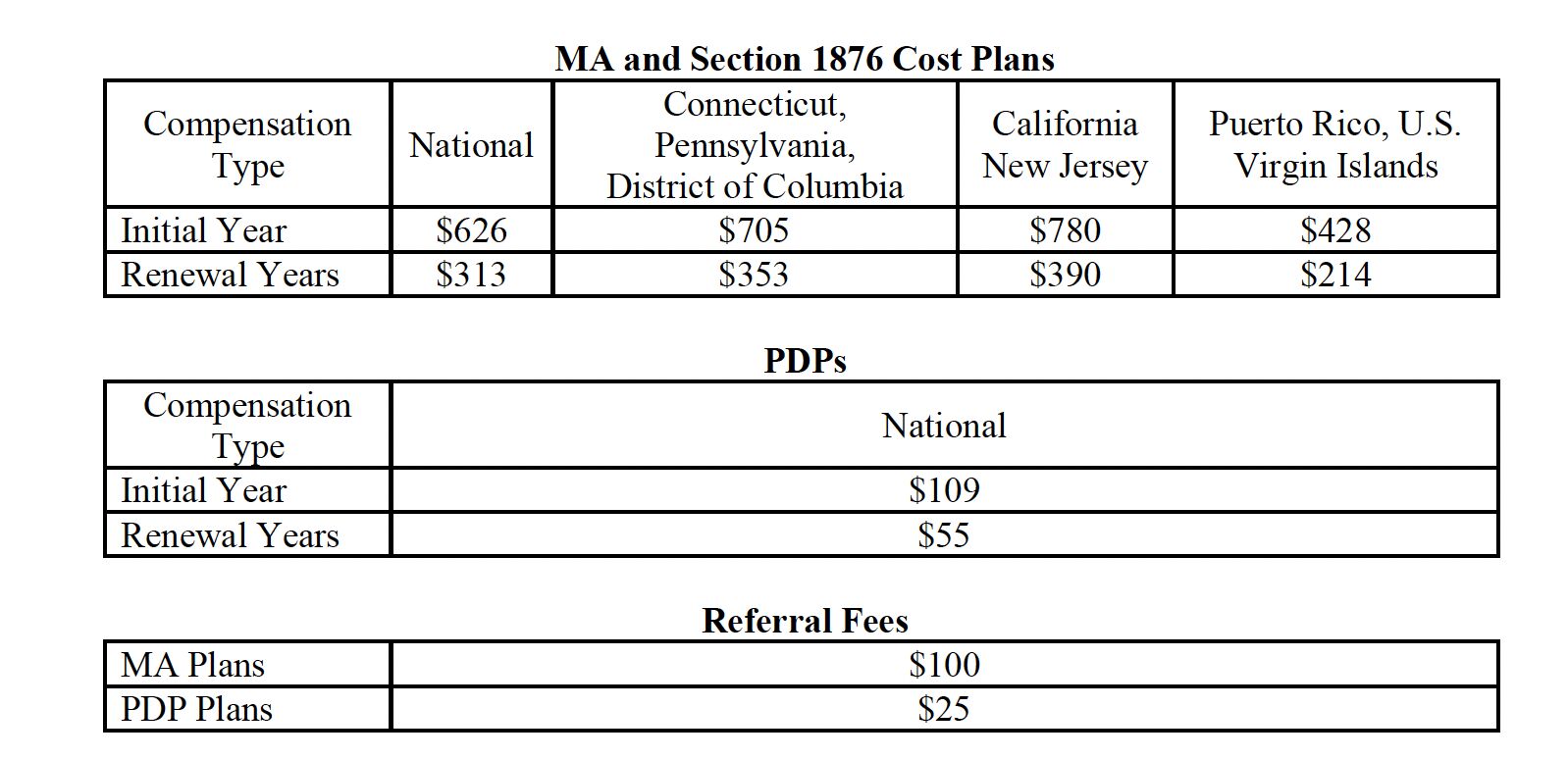

- Compensation that an organization pays to independent agents or brokers for an initial enrollment must be at or below the fair market, limit renewal compensation to a maximum of 50 percent of the fair market value, and limit the amount an organization may pay for referrals. For calendar year 2025, CMS has updated the fair market value amounts:

- Plans must report to CMS whether they intend to use employed, captive, or independent agents or brokers in the upcoming plan year and the specific rates or range of rates the plan will pay independent agents and brokers. Plans must provide this information to CMS by July 26, 2024, for the 2025 plan year. However, Coleman said that CMS will not pursue compliance actions against plans for failing to submit the data by July 26 if they make a good faith effort to submit the data to CMS in HPMS in a timely manner.