The RISE workgroup on third-party marketing organizations (TPMO) recently developed an analysis and set of recommendations for Medicare Advantage Organizations (MAOs) to consider in light of advertising tactics that mislead and confuse MA beneficiaries. We hope you’ll embrace these recommended Medicare marketing compliance steps.

RISE is pleased to have sponsored this important industry work. We would like to thank our board and contributors Kyal Moody, MyPlanAdvocate, and Manny Zuccarelli, Quote Velocity, as well as Michael Adelberg, principal, Faegre Drinker Consulting at Faegre Drinker, for their recommendations incorporated in this document.

Ecosystem

Lead generation is an all-encompassing term used to describe the process of obtaining consumer interest and information with the intent to direct that consumer to an appropriate service provider.

For the purposes of this discussion, the lead generation process is generally facilitated via:

- Web leads: An online application consisting of data collected through a website

- Calls

- Inbound calls: Consumer-initiated calls generated from websites or publicly displayed phone numbers including direct mail.

- Warm transfers: Contact-center generated transfers are produced by calling consumer data, generally in the form of Web Leads.

- Outbound calls: Unsolicited “robo-calling”

Three primary factors underlie the unique experience a consumer will go through via any of the aforementioned Third-Party Marketing Organizations (TPMO) processes.

Point of origin

The initial marketing copy consumers see is heavily weighted toward the consumer journey.

Points of origin may include web leads generated from websites, internet display ads with toll-free numbers, inbound calls from websites, or offline traffic (direct mail, TV).

Currently, the Centers for Medicare & Medicaid Services (CMS) monitors the point of origin with the requirement of standardized material identifications (SMIDs) for all benefits-based marketing. As you will read below, it is our suggestion that CMS and plans require all points of origin to be approved, including outbound calls, and require that this data be passed along to service providers.

Consumer journey

Consumers may be influenced by advertisements or communications in a myriad of ways, and the way their data is used or manipulated, as well as what they experience, is largely dependent on their unique consumer journey.

This journey is affected by everything from their point of origin as well as how they are handled up to the point in which they speak with a service provider.

Degrees of separation

The single most important factor in maintaining quality control over a consumer journey is based on how many entities are involved in the process from the initial point of contact to delivery of that consumer via web lead or call.

A vertically integrated lead generation company responsible for the entire customer journey from the point of origin to the delivery of that consumer to a service provider is the most ideal scenario. In this business model, the lead generation company has complete control over what the consumer sees and hears and is able to best ensure that the consumer is not misled at any point in the process.

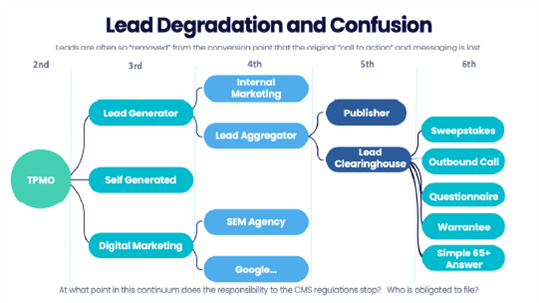

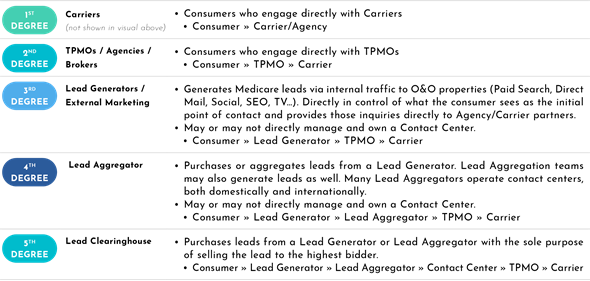

With each degree of separation the possibility of the consumer experience as well as the persistency rate of enrolled consumers deteriorating increases dramatically. The illustration below suggests that carriers or contracted agencies/brokers are one and the same.

*The levels of separation between the carrier/TPMO and the consumer could be reduced by any number of the above columns through a direct relationship.

Example consumer journey

*This diagram may extend to the nth degree depending on how many times a consumer’s information is passed from one organization to another before reaching a carrier/agency.

The fundamental issue lies in marketing agencies having little to no recourse for unethical marketing practices with large financial upside given the high response senior market. Dozens of new plans with highly competitive benefits create a perfect storm inviting marketing agencies to engage consumers without the responsibility of the acute and downstream effects of such practices. We recognize that April’s CMS regulation is clear that MA plans are responsible for any bad conduct from any entity that interacts with members on their behalf, no matter how many layers separate the plans from the activities. However, we are concerned that all these factors above make it very challenging to create a “chain of custody” that transparently tracks and links the activities to specific members and their affiliated MA plans.

Potential solutions

Whitelisting of vendors

Ideally, a whitelisting process for vendors who have passed certification for their ability to provide marketing services would be in place. This process should provide oversight for compliance and security requirements including but not limited to:

- Ownership and control of health-based websites

- Internal contact center operations

- Access to and submission of assets to CMS for approval

- Security compliance measures, e.g. SOC-2 or equivalent

- Licensing in health insurance

- Much like the mortgage vertical which requires lead generators to be licensed as mortgage brokers due to their being considered part of the loan origination process, it is our suggestion that CMS follow the same requirements for lead generators. In all practicality, lead generators who produce Medicare leads should be considered part of the plan enrollment process, and therefore should be required to maintain the same licensing standards and CMS approved certification that a licensed agent would. This has the much desired second-order effect of ensuring that those who lead these marketing agencies are well educated on not just the ethical and compliance requirements, but actual product knowledge as well.

All assets requiring CMS authorizations such as approval

Any and all marketing assets should require CMS approval and/or the approval of plans directly.

Tactics

Some of the current tactics being utilized include:

- Unsolicited outbound calling

- Generally proliferated via offshore contact centers

- Sweepstakes entries

- Generally highly incentivized to lure consumers

- Non-Medicare based websites intended to generate a consent action for a Medicare call

- Extended and other warranties

- Questionnaires

- Co-registration lead generation (e.g., “Are you 65 or older?”)

- Non-specific lead generation websites intended to gather many data points on a consumer with the intention of selling the data to a dozen or more sources

- Non-Medicare interest cross-sales

- E.g., car insurance discussion which routes consumer to Medicare agent

Prohibit incentivized traffic

Incentivized traffic, generally in the form of digital traffic where consumers are encouraged to complete an online application in return for some sort of compensation in the form of money or gifts should be explicitly prohibited.

Many of the coregistration (“coreg”) web leads that are generated begin with an incentivized offering or “survey” which lures consumers to complete online applications while obtaining a multitude of data points that are then “sold” in the form of individualized web leads.

CMS has no history of going after lead generators and will punish MA plans for the sins of those third parties, as noted earlier. However, the Federal Trade Commission and state attorneys general have the authority to go directly after lead generators and likely will receive referrals from CMS when bad conduct is discovered.