Change Healthcare has been using claims reports from its commercial health plan clients to project the increased risk to insurers of post-COVID health impacts in 2021 through 2023. The research is ongoing, but RISE interviewed Peter Colbert, director, customer success decision analytics, to find out what the health care technology company has learned so far.

While research on COVID-19 often looks at the overall impact of the virus on populations, Change Healthcare is taking a different approach. Its studies focus on the subset of COVID cases known to its health plan clients in the Affordable Care Act market to help project the increased risk to insurers of post-health impacts likely to hit in 2021 through 2023. The research entails an analysis of the utilization patterns of these members six months after their last COVID diagnosis.

The company aims to:

- Assess how much COVID-induced changes in health status may impact future costs in the intermediate term

- Quantify how member's risk profiles were changed by the disease

- Assess disease factors that made this population more susceptible to long-lasting COVID impacts in the first place

For its study on the impacts, Change Healthcare evaluated the difference in average monthly claim costs for members who had COVID, starting at least two months following the last date of service of the member’s COVID claims.

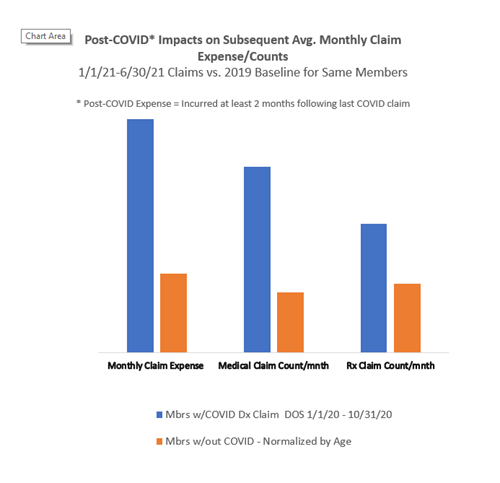

Change Healthcare compared the COVID population's utilization pre- and post-COVID. Based upon the initial analysis, the population’s average monthly claim increased materially during the first six months of 2021 over their monthly utilization in 2019. In contrast, a control group that was selected to match by age distribution saw a far smaller increase in 2021.

This graphic represents the percentage change in post-COVID average claim cost and claim counts for members that had COVID. Change Healthcare looked at the claims incurred over a six-month period starting at least two months following the last COVID claim.

This graphic represents the percentage change in post-COVID average claim cost and claim counts for members that had COVID. Change Healthcare looked at the claims incurred over a six-month period starting at least two months following the last COVID claim.

Peter Colbert, director, customer success, decision analytics, said the research team is revising the data to incorporate the remaining claims as they run out and will publish quantitative measures and the methodology for clients. The insights released so far have helped clients compare their plans against averages to determine whether they are experiencing material deviations.

It’s particularly helpful for clients in states that had a delayed onset of COVID cases. Those members will benefit from looking at the states which had earlier impacts so they can better predict utilization patterns and the eventual impact of COVID costs on premiums.

For example, Hawaii was initially protected from COVID, but case counts subsequently increased. Health plans on the island can use the Change Healthcare data to see what the mainland states experienced and anticipate what their impact will be in the future.

One trend that surprised Colbert was the extent of the increased claim costs for post-COVID members; this suggests that long-term COVID costs are real, and the members will continue to have higher claim costs months to years after first contracting the virus. Initially, researchers thought the cases would be more episodic.

The study focuses on data that is readily available to health insurers. Insurers can identify only a small fraction of members with COVID; the approximately two percent who submitted claims with one of two COVID-related diagnoses (Dx. U07.1 (COVID-19) and Z86.16 (Personal History of COVID-19). Far more members had COVID, but their illness did not raise to a level where it was recorded as a claim. So, the study’s assessment of long-COVID impacts should not be extrapolated beyond those members.

The effects of the Delta variant are largely not reflected because the study period ends in June of 2021. Based on the surge in cases, health plans can expect a larger number of members with a personal history of COVID in 2022. Separately, member specific vaccination data is too sporadically available to health plans to be reliable, however, their widespread use will tamp down the incidence of new post-COVID members in 2022.

Upcoming research will compare telehealth claims and non-telehealth claims to determine the impact of telehealth in terms of capturing serious diagnoses. The insights may help plans assess the role that telehealth plays in their benefit structure and their measurement of risk.

About the subject matter expert

About the subject matter expert

Peter Colbert has worked at Change Healthcare since 2015 with a focus on supporting Affordable Care Act plans. He directs a team that helps clients to use Change software and services to comply with Centers for Medicare & Medicaid Services data submission requirements and to accurately capture and report risk measures. Before joining Change Healthcare, he developed a cross-functional knowledge of health insurance as a consultant for numerous large health plans. Prior to that he led teams developing industry-leading EHR and hospital billing applications.

About Change Healthcare

Change Healthcare is a leading health care technology company, focused on insights, innovation, and accelerating the transformation of the U.S. health care system through the power of the Change Healthcare platform. Change provides data and analytics-driven solutions to improve clinical, financial, administrative, and patient engagement outcomes in the U.S. health care system. Learn more at changehealthcare.com.