Do you have a clear picture of your data, and tools that allow you to easily identify the most impactful interventions to improve patient care?

We recently asked this question during our presentation at the 7th Annual RISE Medicaid Managed Care Leadership Summit, and an overwhelming majority of participants—more than 75 percent—answered “sort of” or “not at all.”

With the sheer volume of health care data available today, it’s no surprise that many health plans find themselves in the data weeds, lacking visibility into provider performance and clarity around which members most urgently need care. While risk adjustment is a complex process for all plan types, Medicaid is especially challenging. For one, each state has its own rules, exclusions, coefficients, and calculations, making it difficult to project revenue and schedule targeted care programs. What’s more, Medicaid member data is also very transient and the Medicaid population is rapidly growing—increasing by 15.7 million members during the pandemic alone.

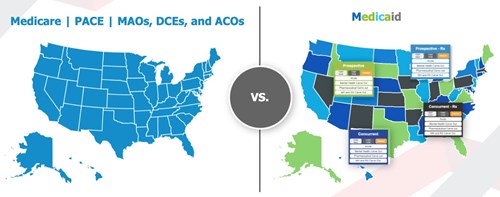

Medicare, PACE, MAOs, DCEs, and ACOs fall under one standard risk adjustment model. Medicaid is an entirely different story, with models varying from state-to-state.

All these factors combined make it critical for Medicaid plans to gain visibility into their data, but even plans with in-house risk adjustment teams can struggle with this issue. Partnering with a technology vendor that can provide the tools to segment data and uncover trends, and the expertise to analyze it in order to determine the most impactful programs can help health plans see beyond the data weeds, improve program performance, and deliver high-quality care.

The solution: Master complexities with advanced analytics

For the past year, Episource has partnered with Driscoll Health Plan, a non-profit insurance plan with a large pediatric population that offers health care coverage to the communities of South Texas. Before partnering with Episource, Driscoll had already identified key areas for improvement, but lacked the tools necessary to pinpoint the specific providers, members, and conditions that needed the most urgent attention.

To address these pain points, Episource conducted a program assessment, a curated action plan that assesses the current state of a health plan’s risk-adjustment program to address the root causes behind what is working and what is not. Together, we extracted the broader trends in our findings to develop three strategies that would have the highest impact based on Driscoll’s unique needs: provider performance, patient engagement, and disease prevalence.

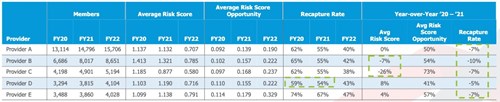

Strategy 1: Segment providers by risk score opportunity

We began by focusing on provider performance, an area Driscoll had previously identified for improvement. Analyzing data for 350 providers, Episource surfaced and ranked the top 10 with the highest risk-score opportunity. Of this group, all had seen a decrease in recapture rates from fiscal year 2020 to 2021. These declines were primarily due to two reasons. Providers were either not seeing members for visits, or not capturing gaps in care correctly.

*For brevity, only the top five providers with the highest risk score opportunity is pictured in the table above.

To pinpoint which category each of these providers fell into, Episource then reviewed claims data. With this information, gap letters can be sent to providers to either flag members that need to be scheduled for appointments, or to share a wide range of suspected conditions that may need to be captured. When prioritizing which providers to engage first, we recommend targeting those with recapture rates below 50 percent. This subset should receive more robust coding education to equip them with the tools and knowledge to perform accurate and efficient coding.

This strategy can be highly effective for small to medium-sized practices but may not be practical for larger ones. Take a practice with 17,000 members, 3,000 of which are not being scheduled for visits. Inundating this practice with thousands of letters would create a great deal of administrative burden. In this instance, we recommend a single, comprehensive gap report. This report can be built in Excel and should aggregate data for all members, allowing providers to create filters, add notes, and customize to their specific needs.

Taking the results from Episource’s analysis, Driscoll built a curated education series for both large and small practices. Because the majority of providers with the highest risk score opportunity were part of its largest practices serving the most members, Driscoll was able to estimate a huge impact on visit completion and recapture rates by targeting just the top 10 providers for improved engagement and education.

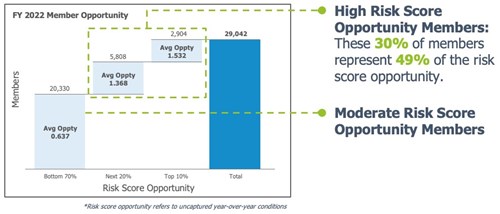

Strategy 2: Segment members by risk score opportunity & SDoH

Next, we turned our attention to Driscoll’s patients, segmenting its 250,000 member population into moderate and high risk-score opportunity. We found that just 30 percent of its members—those that had the highest risk score opportunity—comprised almost half of its total risk-score opportunity. This group represented Driscoll’s sickest members most urgently in need of care. In order to perform targeted engagement to reach these members, we further segmented them out based on visit completion and recapture rates.

For health plans with members who have high visit completion rates but low recapture rates, we recommend leveraging gap letter campaigns that are timed to patient visits. This way, providers will have a list of gaps in care that need to be addressed while the patient is in the office, thus improving recapture rates. As a follow-up action, plans should monitor subsequent charts to ensure providers are successfully recapturing conditions. Members who are below the benchmark in both visit completion and recapture rates should be targeted immediately for appointments or virtual/in-home assessments, prioritized by risk-score opportunity.

After reviewing Episource’s analysis, Driscoll found that the majority of its members with the highest risk score opportunity were located in remote areas of South Texas. To prioritize these members for visit completion, Driscoll has adopted strategies such as flying out city-based specialists, deploying transportation services with contracted vehicles, and expanding its telemedicine programs. By adopting similar strategies and meeting members where they are, health plans can engage members located in “health care deserts,” a phenomenon affecting 80 percent of rural Americans who lack access to care and face a deep shortage of providers.

Strategy 3: Dial in on disease prevalence

Finally, our last area of focus was disease prevalence. Episource’s risk adjustment analytics software pulled the top five suspected CDPS codes for Driscoll’s member population. We found that, of these, only the top two codes were already being captured, PULL (asthma) and PSYML (behavioral health). With these findings, Driscoll was finally able to confirm its speculation that these two conditions—which are commonly found in children, who make up a majority of Driscoll’s member population—were the most prevalent diseases.

Leveraging this third piece of data, Driscoll was able to prioritize new and existing case management teams for targeted programs to treat members with these specific diseases. Combining findings across these areas allows Driscoll to develop more accurate risk and financial projections. This not only provides its executive team with a clearer impact of its risk adjustment team’s work, but it also justifies greater funding to provide patients with the targeted care they need.

The bigger picture: A tech-driven platform of support

Before partnering with Episource, Driscoll suspected which areas of its program it needed to target. However, by leveraging advanced analytics and deep subject matter expertise, Episource was able to provide the concrete data needed to validate its “gut” assessments and home in on exactly who to target and how. As the volume of health care data continues to explode, being able to segment data in this way and build curated solutions tailored to a plans’ unique needs will help realize huge improvements for both providers and members alike.

About the authors

Vijaya Vishwanathan, director of product, Episource

Vijaya Vishwanathan, director of product, Episource

Vishwanathan leads Episource’s risk adjustment and analytics platform by leveraging technology and data to provide insights and segmentation into health care data, helping manage interventions efficiently, and thereby providing better patient care. She brings in-depth knowledge of Medicare Advantage, Medicaid, and other programs from her experience with health plans in various functions.

Lisa Marshall, manager of alternative payment strategies/physician analytics, Driscoll Health Plan

Marshall boasts 25 years of experience in the health care industry and has served across the health care continuum, from managed care organizations to the Department of Defense’s military facilities. Her extensive work as a physician consultant has equipped her with a deep knowledge of the provider—and broader health care—space through a business lens. Currently, Marshall manages a $32M alternative payment program at Driscoll Health Plan.