The learning continued at our hybrid-event with two keynotes, a Medicare Advantage member focus group, legal insights, and a panel discussion on member engagement and experience. Here are a few highlights from our favorite sessions.

Keynote: How to remove the barriers to change and break the status quo bias

We heard a compelling keynote address this morning from International Bestselling Author and Professor Dr. Jonah Berger. As a world-renowned expert on change, word of mouth, influence, consumer behavior, and how products, ideas, and behaviors catch on, Dr. Berger shared actionable steps to change anyone’s mind and how to apply the techniques to be more forward thinking in the managed care space and improve payer, provider, and member relationships.

Change is hard for people, he said. But it is possible to get people to change their minds without providing them with more facts and figures. Because people have a “status quo bias”—the tendency to stick with what they know and do already because it’s familiar and safe—it’s important to think like a chemist and find a catalyst to lower the barrier to change. People need to feel like they are in control and might make the change if they feel as if they came to the decision on their own.

To help give them this freedom and control, Dr. Berger suggests you:

Provide a menu of options: Don’t give people one option. Give them a guided choice of limited choices like a menu at a restaurant. By providing options, it gives people the feeling they are in control, and they won’t focus on the choices not before them.

Ask, don’t tell: Too often we state what we want to happen, but people don’t like to do as they are told. Instead, ask them what they think. By asking questions, rather than making a statement, it allows people to arrive at the right answer and makes them feel like they are participating in the solution. If they came up with the solution in the first place, it makes it difficult for them to resist the change.

Highlight a gap in attitudes and actions: People typically want their attitudes and actions to line up. For example, if they say they care about the environment, they will recycle. But sometimes they are inconsistent, and you can show how their attitudes and actions don’t match. “Too often we think something is an information problem,” Dr. Berger said. “It’s rarely as much an information problem as we think.”

Allow people to experience the benefits before they incur costs: We usually ask people to pay for something upfront before they know for sure that a product or service will make their lives better. There are always some costs to change but the benefits are uncertain. Uncertainty is great for the status quo, but not good for change, he said. Instead, lower the barriers to the product or service by offering “freemiums” or a trial to try the product or service before they upgrade to the premium option. It’s like renting before buying.

Dr. Berger left the audience with two key takeaways that can be implemented immediately: Find your “parking brakes,” or the obstacles and barriers getting in the way of change, and then determine how to mitigate them. “We have to understand the problem and the barriers before we prescribe a solution.”

MA members open up about what they like, dislike about their health plans

One of the most popular sessions each year at RISE West is a focus panel moderated by Kathleen Ellmore, managing director of Engagys, and made up of Medicare Advantage (MA) members who discuss their policy choices, their overall health plan experiences, access to care, and what plans can do to improve services.

This year’s panel of 10 MA members didn’t disappoint and were candid about their likes and dislikes, including the reasons for switching plans, whether they pay attention to Star ratings, and why they would or wouldn’t opt for a telehealth visit in the future.

Reasons why they switch or would consider switching plans: Primary care physician no longer included in the provider network; increase in premiums and copays; and difficulty obtaining referrals to specialists.

The most important factors when considering a new health plan: Easy access to high-quality primary care physician and referred specialists; coverage of procedures and medications; cost (premiums and copayments); and supplemental benefits (such as gym memberships and vision coverage for contact lenses and prescription eyeglasses).

How they find out about different health plans: Most said they receive paper flyers in the mail and then look at the individual health plans on their web sites to compare coverage and costs.

Whether Star ratings factored into their decision of enrolling in a plan: Only two panelists were familiar with Stars. Of the two, one senior said he did consider Star ratings as well as word of mouth when he chose his plan. The other said the rating was not a determining factor when she enrolled in her plan. However, when Ellmore explained the Star rating system, most of the panelists said they would look for 1-5 quality rating the next time they considered switching plans.

Their thoughts on the level of communication from their health plans: Responses were mixed. Five felt their plan offered just the right level of communication, three said they didn’t get enough, and two thought they received too much information. One senior said he got too many explanation-of-benefits forms that came months after his doctor visits, so it was difficult to reconcile whether he actually received the service. But another said he wished he got the explanation of benefits more frequently. Two members said they prefer getting statements via mail so they can write notes on them for future reference; others preferred digital and say they can print statements if they need a hard copy.

Whether they feel as if their plans know them as individuals: Only two felt their plans really knew them. One senior said the health plan follows up with him to see if he made it to his scheduled appointments, including visits to his urologist and podiatrist. The plan also sends him a printout of his conditions and what he needs to address with the physicians. “It makes me feel good and gives me a sense they know me,” he said. Among those who didn’t feel as if their plan knew them: Ways that health plans could personalize communications is to reach out about preventive care services available to them and send information about how to follow a healthier lifestyle.

What they think about telehealth visits: Half of the panel said they participated in a telehealth visit during the pandemic. Two didn’t like the experience; one said it was superficial and he missed the hands-on aspect of in-person visits; the other scheduled three separate appointments and each time was kept in a waiting room for hours and the doctor failed to show up. Other panelists had more positive experiences. They liked the option because they lived far away from their providers. One woman said she made an appointment after hours and the doctor was very responsive, even checking in on her in the waiting room to let her know how long it would be until he could meet with her.

How plans could improve the overall member experience: Provide information (even in an email) about how close they are to reaching the donut hole and suggest inexpensive alternatives to purchasing medication once they reach it; offer online chat capabilities on their websites so they can get an immediate response to their questions or concerns rather than waiting for a return phone call days later; cut the cost of premiums; allow seniors to use their entire discretionary account amount for over-the-counter products at once, rather than divvying up the amount quarterly (“I could buy a better blood pressure monitor with $160 at the beginning of the year, rather than a cheaper version with the $40 quarterly allowance”); offer members a specific name and contact information of a benefit specialist who they could reach out to with questions; and provide extra incentives to encourage preventive care, such as gym memberships.

AN INTEGRATIVE, CROSS-FUNCTIONAL APPROACH IS KEY TO EFFECTIVE MEMBER ACQUISITION, OUTREACH, AND RETENTION

During the member engagement and experience track this afternoon, co-panelists Scott Weiner, director, government programs, Virginia Premier, and Archie Dey, director of consumer experience and insights, SCAN Health, spoke about the strategies they’ve found to drive results in member acquisition, outreach, and retention.

A fundamental approach to their strategies: Cross-functional coordination across departments to align initiatives and member communications. Both Weiner and Dey agreed coordination between teams is critical to ensure members aren’t inundated with communications.

SCAN Health has been a 4.5-Star plan for the last four years. A cross-functionality type of intervention that SCAN uses is the plan’s coordination of care program for prescriptions. To provide a seamless member transition during the onboarding process and prevent lapses in prescriptions, the plan collects data on members’ prescriptions and identifies any that don’t fall within the SCAN formulary. SCAN then coordinates with the provider group to make sure the member has at least one month of the prescription and then begins the prior authorization process. The health plan also works with members to ensure they understand the different prescription options available for them.

“It’s a coordination between the sales team, enrollment team, customer service team, health care service team,” said Dey. “What we do is run a cross-functional initiative where the stakeholders from the different teams come together, and we come up with a process flow which identifies what each team has to do as part of the entire workflow.”

Both Weiner and Dey discussed how their plans are leveraging cross-functional coordination in their efforts to address social determinants of health (SDoH) and promote health equity. The plans’ strategies include a new case management system to identify the ZIP code areas likely to experience social needs, a peer-to-peer program between older adult volunteer members and members in need of connection, and a vaccination program for homebound members.

While showing ROI and business case around SDoH and health equity can be a challenge, they remain a priority for the plans. “Think small, prove the value in it, and then build on top of it because I don’t always believe attribution is the right question to solve for,” explained Dey. “My perspective is you need to look at the entirety of the interventions where the whole is bigger than the sum of its parts.”

LEGAL EAGLES OFFER INSIGHTS ON MA RISK ADJUSTMENT, FALSE CLAIMS ACT CASES, COMPLIANCE ISSUES

Our compliance & audit readiness track featured a blockbuster panel of legal experts who offered insight into the current state of the law in Medicare Advantage risk adjustment and discussed the difference between “garden-variety breaches of contract or regulatory violations,” which are not actionable under the False Claims Act (FCA), and compliance failures that constitute actual fraud.

Among the takeaways:

The government is intervening in a high percentage of risk adjustment qui tam complaints, said Edward Baker, counsel in Constantine Cannon’s District of Columbia’s office. He noted that the government has intervened or participated in 15 of the 22 whistleblower cases filed – an astronomical number. Those cases with government involvement have either settled or are still pending. The result of those cases is a clear theme: You can’t seek payment for diagnoses that aren’t supported in the medical record.

More and more investigations focus on reverse false claims, says Jonathan A Porter, who serves as assistant United States attorney in the Savannah, Ga. Office of the United States Attorney’s Office for the Southern District of Georgia. These types of claims involve claims submitted in the past, but later someone in the organization determines it was improper. In that case, the organization has an obligation to go back to someone within the government and make it right. Materiality–or whether the defendant knowingly violated a requirement that is known to be material to the government’s payment decision–is crucial in these cases. The key is determining the line between “garden variety” or a mere regulatory violation or whether the case crosses over to fraud.

Even “garden variety regulatory violations” can become a billion-dollar problem, warned Stephen Bittinger, health care audit & integrity partner, K&L Gates, LLP. His advice is to stay current and be aware of what the law says. While it’s impossible to keep track of every single process, he suggests that organizations look at processes quarterly so they can catch problems and correct anything in a timely manner. “The big problem is if your internal set of data is different than what you submitted to the government,” he said, adding that organizations should have well-defined policies and protocols for discovering errors and correcting errors quickly.

Follow available guidance and adapt your practices to limit risk, said William Sarraille, senior partner, health care group in the District of Columbia office of Sidley Austin LLP. Guidance is limited and it’s difficult because so many fundamental issues are not addressed, he said. His advice is for organizations to follow risk adjustment data validation audits and enforcement developments to best understand lessons on what went wrong.

Changes may be coming to the False Claims Act, says Porter. The origins of the federal law date back to the Civil War when contractors provided fraudulent goods to the Union Army. Porter said he’s heard that Sen. Chuck Grassley (R-Iowa) and others are interested in tweaking the False Claims Act to update it so it can be better applied to the complex issues the industry faces today. “I think we will see something like that in the years to come as courts continue to figure out what the delineation is between garden variety and knowing false claims,” he said.

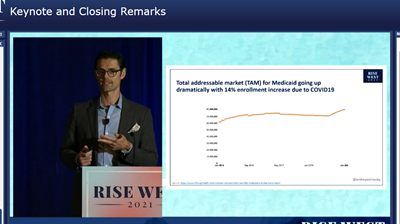

Keynote Dr. Ostrovsky on investing in businesses that serve the most vulnerable populations

The conference concluded with an impressive keynote by Andrey Ostrovsky, M.D., managing partner, Social Innovation Ventures, and the former chief medical officer for the U.S. Medicaid Program.

Dr. Ostrovsky, a pediatrician, shed light on where money can be made in the health care space and where that money will do good, particularly investments that serve vulnerable populations and innovations that address the social determinants of health. He encourages making investments into businesses that can show evidence behind their solutions (evidence that supports their marketing claims), those businesses who have diverse leaders and who offer a unique perspective to innovation, and those that will ensure the solution will get in the hands of patients.

He provided several examples of these types of innovations, including a business that uses virtual reality to treat chronic pain, a nonpharmacological way to manage ADHD, and artificial intelligence that can diagnose autism (a diagnostic tool designed to be anti-racist and unlike human beings, doesn’t discriminate based on race, ethnicity, socioeconomic status, or geographic area). He said he is also broadening his investments to include affordable housing and artistic endeavors.

By making an investment in these types of businesses and showing that his fund can outperform the consensus internal rate of return, Dr. Ostrovsky said he hopes institutional investors will increase their funding of innovation for vulnerable populations.

So far, the results have been promising:

- Since 2018, he has invested in 26 companies

- Fifteen of those companies had diverse founders (not white, non-heteronormative, and/or non-male)

- Twelve raised first institutional round since his investment

- The internal rate of return net fees was 41 percent (exceeding his goal of 30 percent)

- Return on equity has been 301 percent