Health insurers that have a low conversion of commercial to Medicare members may have an awareness issue. Challenges on increasing awareness include siloism among commercial and Medicare departments within health insurer corporations. Opportunities include creating strategies to encourage collaboration and incentives to provide the motivation for these groups to work together and provide the right Medicare plan to their commercial members.

Many commercial members are not aware their health insurers offer Medicare plans

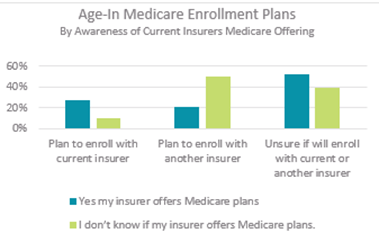

Deft Research examined the importance of awareness of Medicare offerings as eligible seniors age-in to Medicare. This chart shows the stark contrast between the Medicare enrollment plans of members who are aware of their current insurer’s Medicare offerings and those who are not aware.

Members who are aware of their insurers’ Medicare plans are more than twice as likely to plan on continuing with their current insurer than to switch to another insurer.

Source: Deft Research 2017 Medicare Age-In Study

Source: Deft Research 2017 Medicare Age-In Study

In contrast, members who are unsure about their current insurers’ offering are more than twice as likely to plan on switching insurers. Clearly, getting the word out to existing members is critical to avoid losing these members to competitors.

Separate departments make communication difficult

Most health insurers have separate departments and teams of people who manage commercial health insurance versus Medicare. This siloism within the corporation makes it difficult to collaborate.

During RISE’s The 12th Annual Medicare Marketing & Sales Summit, Sarah Fernandes from Health New England suggested organizations set internal goals to increase collaboration between the commercial and Medicare marketing and sales departments. Increasing the number of conversations between these two groups opens more opportunities to work together. Fernandes said these conversations have led the two departments at her health plan to collaborate on several projects to increase conversion of commercial members to Health New England Medicare plans.

Incentives motivate commercial agents to refer members to Medicare agents

Another strategy that we heard many plans using is a referral program. The program works well because commercial agents already have a relationship with the members, but Medicare agents have the Medicare plan knowledge. The referral allows members to learn about Medicare plans that are right for them, and the commercial agent participates in the meeting to build on the trust the member already has with the health plan. This provides a better experience for the member and strengthens the relationship that the member has with the plan.

Medicare referrals from indirect channels bring more opportunities with commercial members

The Centers for Medicare & Medicaid Services’ recent guideline changes that focus more on educational materials versus member acquisition and marketing materials opens the door to referrals. Health care providers area a key source of referrals given their relationships with members and their understanding of their medical conditions.

Holly Ackman from SCAN Health Plan emphasized the importance of training and education during her session of The 12th Annual Medicare Marketing & Sales Summit. The SCAN brand is built on developing relationships both outside of the organization with members and internally with other departments. SCAN aims to get the right information to the right people, so members feel like they’re heard and that the health plan knows their personal situation, which leads to a better member experience. Ackman said SCAN’s strong brand reputation has also led to Medicare members who are in their late 80s to refer the health plan to their children who are in their mid-60s.

Deft Research’s syndicated research studies provide a national benchmark for health insurance carriers to gauge the Medicare and Employer Group and Individual markets. Health insurers that are interested in surveying their own members and prospects engage Deft Research in custom research studies to provide insight for their marketing and product strategies. Contact Deft Research with any questions you may have regarding syndicated and custom research needs.

Catherine Mandler l cmandler@deftresearch.com 612-436-8313

About Us

Catherine Mandler, Research Manager and Director of Marketing and Communications joined Deft Research in 2017. She has over 25 years of Marketing and Advertising experience with both Fortune 500 and small entrepreneurial clients. She has experienced many of the same organizational and market challenges that health plans face today. She looks forward to bringing innovative solutions to market and working on projects that improve the member experience which all start with gaining a better understanding of the consumer through data and research.

Deft Research is a market research firm serving over 110 insurers nationwide blending primary research with data from Deft’s syndicated studies and Big Data to help clients grow their businesses. Deft’s research specialties include product development, member experience, quality rating diagnostics, list scoring, and market assessments. Deft’s syndicated products, known as Market Insights Studies, are the health insurance industry’s leading source for insight on the attitudes, opinions, and behaviors of key decision-maker populations including consumers, agents and brokers, Group benefit administrators, providers, and plan stakeholders.