A new analysis released by the Better Medicare Alliance finds that Medicare Advantage (MA) beneficiaries report more savings each year than those in original Medicare.

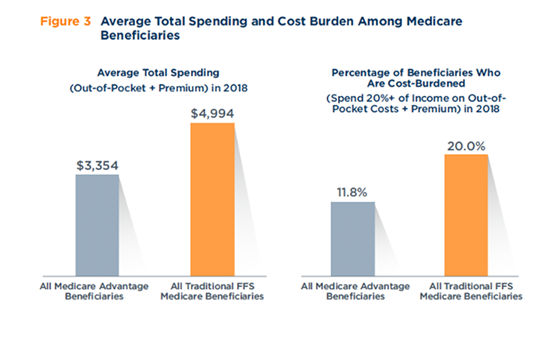

The analysis, conducted by ATI Advisory on behalf of the Better Medicare Alliance, a leading policy and advocacy organization for MA, found that MA beneficiaries report $1,640 less in total health spending than those in original Medicare. It also showed a higher proportion of low- and modest-income beneficiaries in MA than original Medicare.

The study was based on 2018 Medicare Current Beneficiary Survey (MCBS) data, the most recent year available, and represents an increase in consumer savings from years past. ATI Advisory’s report last year, which analyzed 2017 MCBS data, showed a $1,598 lower health spending in MA. Data from 2016 found a savings of $1,276.

Source: ATI Advisory

Among the findings of the latest report: There is a 40 percent lower rate of cost burden in MA than original Medicare (11.8 percent versus 20 percent). The lower cost burden is significant given that nearly 53 percent of MA members live below 200 percent of the Federal Poverty Level, compared to 39 percent of original Medicare members, BMI noted. Cost burden is defined as spending 20 percent or more of one’s income on health costs.

“Congress and the Biden administration have set a worthy goal of lowering consumer health care costs and securing the best value possible for the Medicare dollar. This analysis shows that Medicare Advantage continues to do exactly that,” Allyson Y. Schwartz, president and CEO of the Better Medicare Alliance, said in the study announcement.

Allison Rizer, principal at ATI Advisory and study lead, said the analysis shows that MA continues to prove its value. “We’re seeing plans increasingly shifting toward person-centered care, with innovative supplemental benefits and clinical models,” she said in the study announcement. “This latest analysis shows that Medicare beneficiaries also rely on Medicare Advantage for financial protection against high out-of-pocket and premium costs.”