When it comes to health insurance sales, the process doesn’t end once members sign their enrollment applications. Onboarding and care transition are key to member satisfaction and retention. When members have a positive experience with their new plan from the very beginning, it sets the stage for a successful, long-lasting relationship. In other words, the enrollment and onboarding process is an interaction, not just a transaction.

In 2016, Bloom began exploring ways to add value to both members and health plans during the enrollment process. After months of discussions with clients and research on needs and opportunities, Bloom developed a way to leverage the 100 percent contact rate with members at the time of enrollment to facilitate a better transition of care. Because compliance is critical, Bloom  approached the

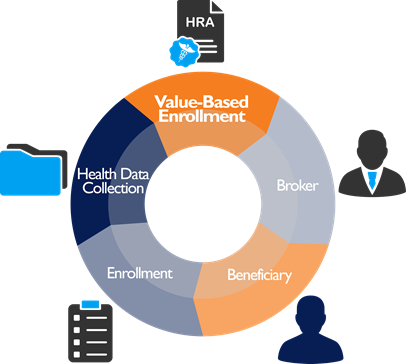

approached the  Centers for Medicare & Medicaid Services (CMS) in January 2017 with an innovative solution that would allow for the collection of Health Risk Assessment (HRA) data and the scheduling of Annual Wellness Visits (AWVs) at the point of sale. CMS noted that “nothing in the program design conflicts with existing CMS regulations and sub-regulatory guidance,” thus allowing Bloom to move forward and launch its Value-Based Enrollment (VBE) process that fall.

Centers for Medicare & Medicaid Services (CMS) in January 2017 with an innovative solution that would allow for the collection of Health Risk Assessment (HRA) data and the scheduling of Annual Wellness Visits (AWVs) at the point of sale. CMS noted that “nothing in the program design conflicts with existing CMS regulations and sub-regulatory guidance,” thus allowing Bloom to move forward and launch its Value-Based Enrollment (VBE) process that fall.

More member engagement

Through VBE, plans can collect important health-related information, quality inputs, and disease-state inputs prior to a member’s effective date. The process can be initiated by field agents and telesales representatives or by consumers who have completed self-enrollment. Agent-assisted VBEs are an agent-initiated task and, as such, eligible for administrative payment, according to CMS. The collected data is held in abeyance until the plan receives confirmation of new member accretion.

Members also can schedule their AWV when they enroll. This engages the member with the plan immediately, improving satisfaction and creating a positive member experience from the first day they begin thinking about their new coverage.

Better care coordination

VBE provides health plans with early data on new enrollments to help guide case management. The HRA used is fully customizable to health plans, allowing them to focus on quality, clinical and risk measures important for their new population. Ultimately, this allows health plans to deliver on the promise to invest in member health immediately.

By obtaining important health information from new members at the time of enrollment, health plans can identify high-risk patients and stratify incoming enrollees. This improves the coordination of care and increases doctor visits, required tests, and other screenings.

Improved health literacy

The Medicare enrollment process can be overwhelming. In addition, many Medicare patients don’t understand the full extent of the benefits available to them. The AWV, in particular, is an often-overlooked benefit. According to a recent study, less than 15 percent of Medicare patients take advantage of the free AWV, which can play an important part in preventing future health issues.

By educating new members on the need for an AWV and assisting them in scheduling it, the VBE process improves their health literacy. Members understand the importance of creating a personalized prevention plan with their doctor and taking a more active role in maintaining their health.

Diminished cancellation rate

In the first four months following the launch of the VBE process, which included an Annual Election Period (AEP), 74 percent of members eligible for VBE elected to participate. Of those participating, 66 percent fully completed an HRA at the time of enrollment. By engaging new members early in the process, rapid disenrollment was 50 percent lower in the group that fully completed an HRA.

For more information on the VBE process, go to www.BloomInsuranceAgency.com or contact bivey@bloominsuranceagency.com.

About

Brooke Ivey joined Bloom as a phone agent in 2007. Since then, she has steadily moved up the ranks to become the leader of Bloom’s business development team. Ivey has extensive experience in both Medicare sales and call center campaigns. With a constant ear to the ground, she identifies issues and needs in the health insurance industry and works to solve them.

Brooke Ivey joined Bloom as a phone agent in 2007. Since then, she has steadily moved up the ranks to become the leader of Bloom’s business development team. Ivey has extensive experience in both Medicare sales and call center campaigns. With a constant ear to the ground, she identifies issues and needs in the health insurance industry and works to solve them.