Deft Research’s latest national market research report examines the age-in conversions of current commercial members, the factors that drive enrollment with consumers after the age of 65, and the key times that seniors shop for Medicare coverage. Here are three findings from the executive summary of the 2019 Age-In Study, which surveyed 2,400 seniors who are eligible for Medicare.

1. Employment and economic trends have led older consumers to delay retirement and enrollment in Medicare plans

1. Employment and economic trends have led older consumers to delay retirement and enrollment in Medicare plans

Unemployment rates for workers ages 60 to 64 are at 2.5 percent, below the 50-year low jobless rate for all U.S. workers of 3.6 percent. This tight labor market means many consumers are continuing to work after they turn 65 and delaying retirement (and enrollment into Medicare plans).

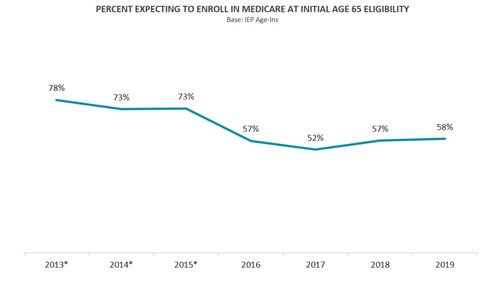

As a result, Medicare marketers need to rethink their marketing campaigns to reach this population. In the past Medicare marketers could rely on the Initial Enrollment Period (IEP) to cast wide nets to bring in the largest number of consumers as they “aged-in” to Medicare. Most health plans would mail consumers at the start of their IEP and keep in contact with them through the three months after they turned 65. But this tried-and-true approach is losing favor. The report notes that 20 percent fewer consumers today plan to enroll during their IEP as opposed to just a few years ago.

“With the age for full Social Security benefits only growing over time, nothing is likely to reverse this trend short of another large-scale economic recession,” the executive research brief said.

Source: Deft Research Age-In Study Executive Research Brief

2. Conversion rates of commercial members to Medicare are mediocre

Many prominent carriers struggle to convert current commercial members to Medicare products, according to the report. Less than half of current 64-year-olds know if their commercial carrier offers Medicare products, and that number drops to less than a quarter when it comes to 63-years-old.

“Such low awareness at such a late stage in the conversion game is problematic as FMOs (field marketing organizations) and their agents are waiting in the wings to swoop in,” the summary of the study said.

Indeed, Deft found that 40 percent of agents now consider consumers 60 years-old and younger to be prospects.

“If only commercial managers at health plans were that committed to winning their business,” the executive research brief said. “For these reasons and others, current conversion rates in the industry are mediocre at best, depending on what commercial line of business the member comes from.”

3. Post-IEP marketing may be a viable option to attract more enrollees

The 2019 Age-In Study found that the risk of a member opting for Original Medicare only increases by 50 percent after age 67 (when compared to younger Age-Ins). This is a “double whammy.” Their move to Medicare becomes less predictable after the age 66, but their likeliness to opt for private insurance worsens as well.

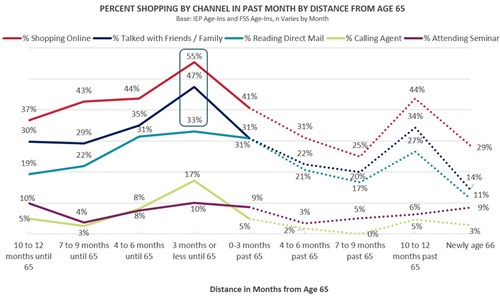

However, the executive research brief said that post-IEP marketing is a viable tact if the age range targeted is aligned with when consumers plan to jump into Medicare. Indeed, 65 years and 10 months can produce a nice secondary bump in response, second only to traditional IEP campaign timing.

Source: Deft Research Age-In Study Executive Research Brief