Many variables can impact the member/patient experience—but some are more controllable than others.

J.D. Power’s recent 2020 U.S. Medicare Advantage Study has concluded that Medicare Advantage (MA) plans struggle to communicate effectively with members. The situation is compounded by CMS’ recent announcement of Star rating measurement weight increases to certain Patient Experience and Complaints Measures (increasing in some cases from 2X to 4X). As a result, investments in improving strategies and tactics to optimize communications will generate financial benefits like never before.

Many variables can impact the member experience—some more controllable than others. While individual providers may be difficult to control, the health plan’s ability to impact member satisfaction directly may be more achievable than you realize: communicate proactively about the available network, leverage optimal communication channels to ensure delivery, and apply communications best practices to maximize results.

RELATED: Study: MA plans miss the mark when it comes to member communication

The realities of the upcoming Annual Enrollment Period (AEP) are beginning to take shape as regions of the United States vacillate between reopening and shuttering. Unable to rely upon live events and one-on-one discussions, MA plans will employ new strategies to reach targeted populations and manage retention.

“This gap has been amplified during the COVID-19 pandemic as consumers are 3.3 times more likely to receive a helpful communication from their bank than from their health plan."

Source: J.D. Power 2020 U.S. Medicare Advantage Study

In our work with clients, we have seen how targeted, intentional communications strategies and tactics can positively impact health care consumer satisfaction and engagement. And we’ve also seen what doesn’t work—at a recent Engagys/RISE panel discussion with consumers living with SDoH issues, it came to light that despite plans having programs to support and overcome social barriers, the consumers in the panel were not even aware of the programs.

As the clock ticks, where best to put forth efforts? The answer to that question will differ based on the details of a particular health plan’s situation. That said, the suggestions below should help start the discussion. We’ve directly addressed the challenges cited by J.D. Powers by providing some recommendations for immediate consideration.

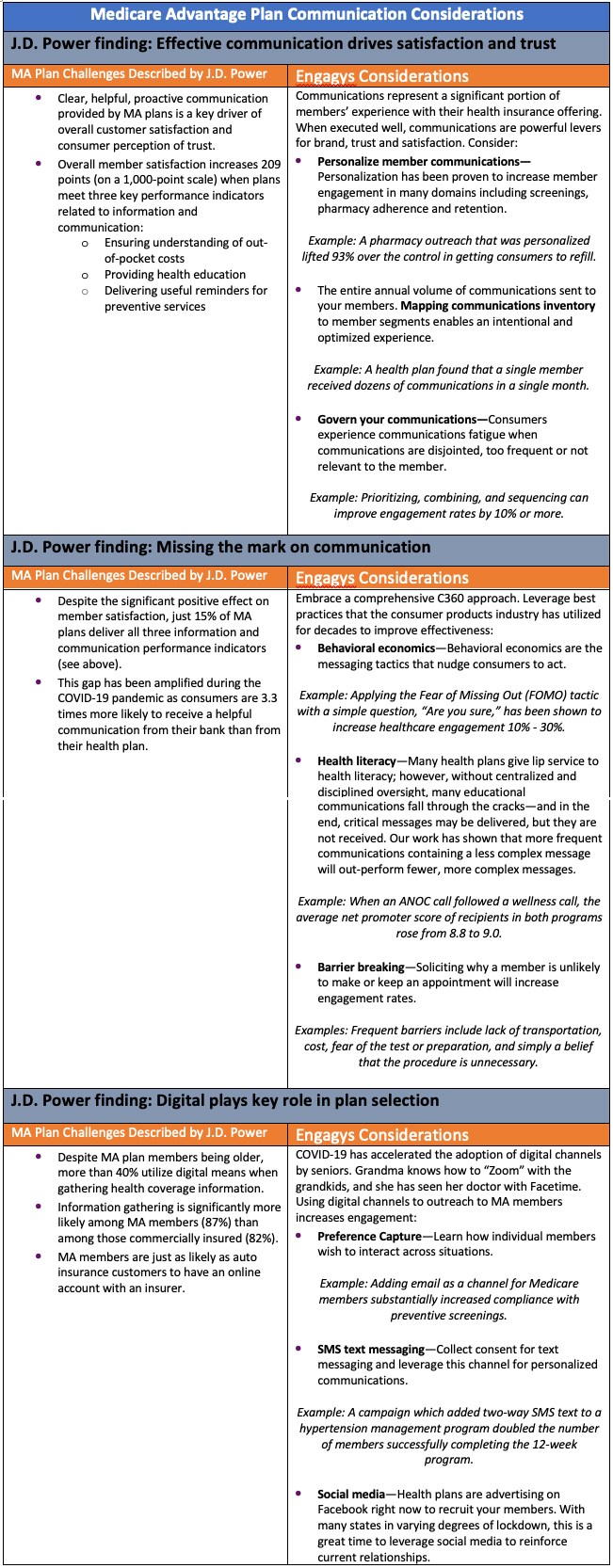

Medicare Advantage plan communication considerations

J.D. Power finding: Effective communication drives satisfaction and trust

Challenges:

- Clear, helpful, proactive communication provided by MA plans is a key driver of overall customer satisfaction and consumer perception of trust.

- Overall member satisfaction increases 209 points (on a 1,000-point scale) when plans meet three key performance indicators related to information and communication:

Ensuring understanding of out-of-pocket costs

Providing health education

Delivering useful reminders for preventive services

Engagys considerations

Communications represent a significant portion of members' experience with their health insurance offering. When executed well, communications are powerful levers for brand, trust, and satisfaction. Consider:

Personalize member communications—Personalization has been proven to increase member engagement in many domains including screenings, pharmacy adherence, and retention.

Example: A pharmacy outreach that was personalized lifted 93 percent over the control in getting consumers to refill.

The entire annual volume of communications sent to your members. Mapping communications inventory to member segments enables an intentional and optimized experience.

Example: A health plan found that a single member received dozens of communications in a single month.

Govern your communications—Consumers experience communications fatigue when communications are disjointed, too frequent or not relevant to the member.

Example: Prioritizing, combining, and sequencing can improve engagement rates by 10 percent or more.

J.D. Power finding: Missing the mark on communication

Challenges:

- Despite the significant positive effect on member satisfaction, just 15 percent of MA plans deliver all three information and communication performance indicators (see above).

- This gap has been amplified during the COVID-19 pandemic as consumers are 3.3 times more likely to receive a helpful communication from their bank than from their health plan.

Engagys considerations

Embrace a comprehensive C360 approach. Leverage best practices that the consumer products industry has utilized for decades to improve effectiveness:

Behavioral economics—Behavioral economics are the messaging tactics that nudge consumers to act.

Example: Applying the Fear of Missing Out (FOMO) tactic with a simple question, “Are you sure?” has been shown to increase health care engagement 10 percent to 30 percent.

Health literacy—Many health plans give lip service to health literacy; however, without centralized and disciplined oversight, many educational communications fall through the cracks—and in the end, critical messages may be delivered, but they are not received. Our work has shown that more frequent communications containing a less complex message will out-perform fewer, more complex messages.

Example: When an ANOC call followed a wellness call, the average net promoter score of recipients in both programs rose from 8.8 to 9.0.

Barrier breaking—Soliciting why a member is unlikely to make or keep an appointment will increase engagement rates.

Examples: Frequent barriers include lack of transportation, cost, fear of the test or preparation, and simply a belief that the procedure is unnecessary.

J.D. Power finding: Digital plays key role in plan selection

Challenges:

- Despite MA plan members being older, more than 40 percent utilize digital means when gathering health coverage information.

- Information gathering is significantly more likely among MA members (87 percent) than among those commercially insured (82 percent).

- MA members are just as likely as auto insurance customers to have an online account with an insurer.

Engagys considerations

COVID-19 has accelerated the adoption of digital channels by seniors. Grandma knows how to “Zoom” with the grandkids, and she has seen her doctor with Facetime. Using digital channels to outreach to MA members increases engagement:

Preference capture—Learn how individual members wish to interact across situations.

Example: Adding email as a channel for Medicare members substantially increased compliance with preventive screenings.

SMS text messaging—Collect consent for text messaging and leverage this channel for personalized communications.

Example: A campaign which added two-way SMS text to a hypertension management program doubled the number of members successfully completing the 12-week program.

Social media—Health plans are advertising on Facebook right now to recruit your members. With many states in varying degrees of lockdown, this is a great time to leverage social media to reinforce current relationships.

Interested in learning more? Contact us at www.engagys.com.

About the author

Kathleen Ellmore is a pioneer in bringing the best of consumer marketing and data-driven methodologies to health care to motivate better health decisions. As managing director of Engagys, Kathleen leverages the best of behavioral economics, the latest in evidence-based communications combined with the insights from over a billion consumer interactions in health to help health care organizations close the last mile of consumer engagement. Kathleen has been recently named as a consultant to the first ever FDA Patient Engagement Advisory Committee (PEAC). She received Stevie awards for highlighting opportunities for improving the lives of people with chronic conditions. She speaks regularly on the national stage on many topics including: driving consumer health engagement, creating better consumer experience in health care, motivating, and inspiring consumers, and using data to drive consumer behavior. Kathleen is not just a health care consumer expert, she’s a health care consumer. Her daughter has cerebral palsy; thus, Kathleen lives daily the complexity of today’s health care system.

Kathleen Ellmore is a pioneer in bringing the best of consumer marketing and data-driven methodologies to health care to motivate better health decisions. As managing director of Engagys, Kathleen leverages the best of behavioral economics, the latest in evidence-based communications combined with the insights from over a billion consumer interactions in health to help health care organizations close the last mile of consumer engagement. Kathleen has been recently named as a consultant to the first ever FDA Patient Engagement Advisory Committee (PEAC). She received Stevie awards for highlighting opportunities for improving the lives of people with chronic conditions. She speaks regularly on the national stage on many topics including: driving consumer health engagement, creating better consumer experience in health care, motivating, and inspiring consumers, and using data to drive consumer behavior. Kathleen is not just a health care consumer expert, she’s a health care consumer. Her daughter has cerebral palsy; thus, Kathleen lives daily the complexity of today’s health care system.