Each year, Engagys and RISE partner to conduct the annual State of Consumer Health Engagement Survey. The survey is an examination of health care consumer engagement practices to further understand the rate at which health plans across the country are achieving engagement success and where they are investing in the future for better engagement and experience. Started in 2016, this survey now has four complete years of trend data.

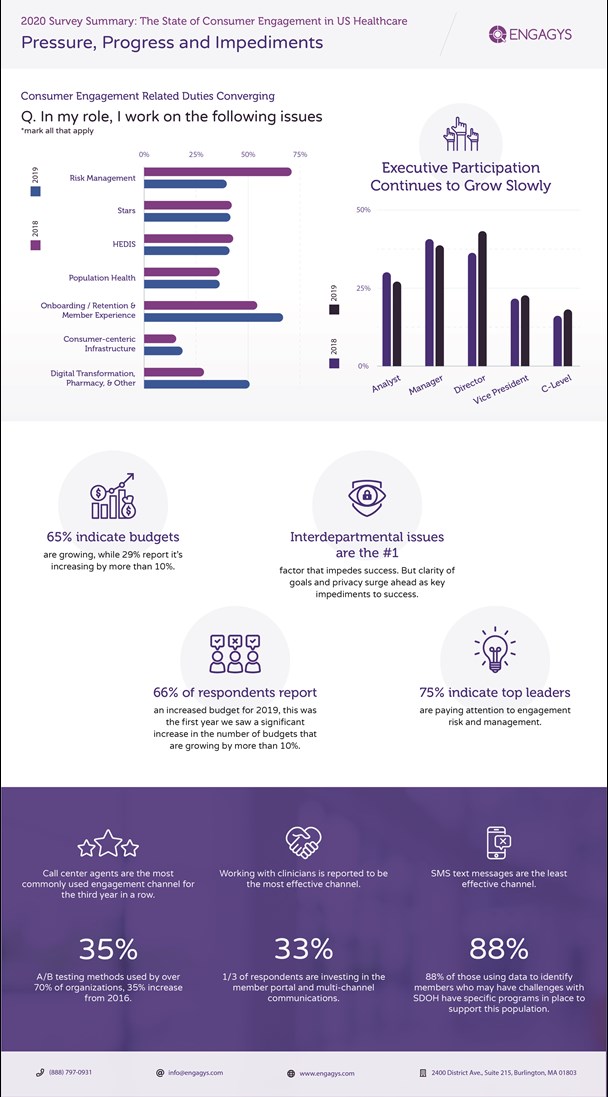

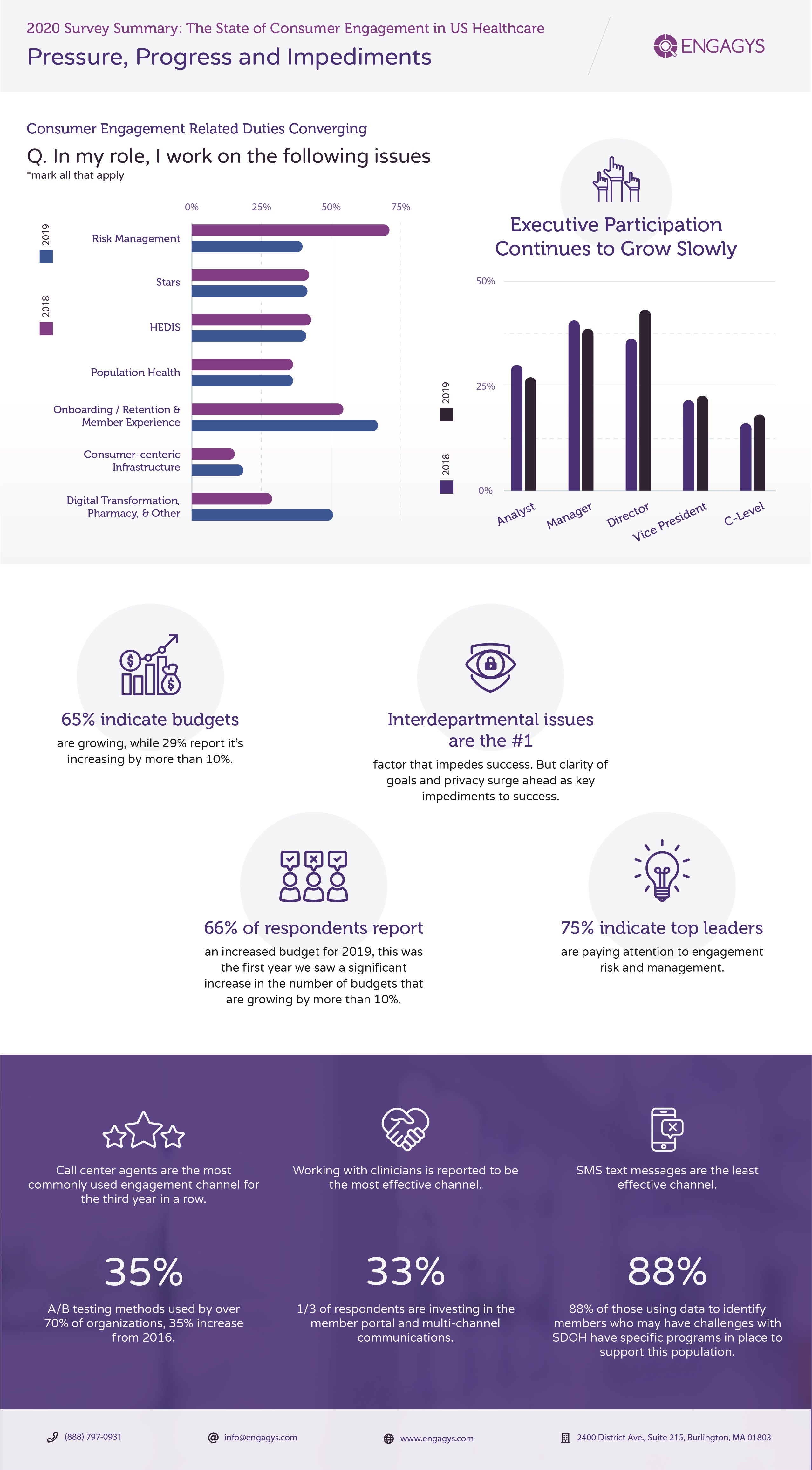

In the last survey, pre-COVID, we saw four years of steady trends. Leadership attention and resources for consumer engagement teams continued to climb. Budgets grew in all four years and accelerated considerably in the most recent year. 2019 was the first year we saw a significant increase in the number of budgets that are growing by more than 10 percent. The increase suggests that organizations see the need to accelerate work in consumer engagement specifically.

This is in line with what we often see with Engagys clients. The companies focused on creating the best consumer experience are spending more time and money to accelerate these initiatives, widening the gap between them and their competitors. For example, a few years ago most plans were reporting that they had captured digital preferences for 10 percent-15 percent of their population. Now our clients often report preferences in the 30 percent-40 percent range.

What’s impacting success?

Lack of alignment across the organization is often cited as the number one reported impediment for consumer engagement success. This lack of alignment often leads to consumer collisions, overcommunications, or consumer confusion. Data challenges although still evident, have improved. Compared to last year, data access significantly dropped in ranking and in its place, clarity of goals and privacy/HIPAA are reported as the #2 and #3 highest-ranking challenge among teams.

The impact of consumer engagement is reportedly unclear when it comes to medical spend, which may cause a lack of clarity when it comes to goals. Plans still struggle to quantify the value of a digital consumer, a program that addresses social determinants of health or even the lifetime value of an engaged consumer. Lastly, the industry still falls behind in consumer 360 technologies that are table stakes in other industries. That coupled with the fact that there was little change in channel effectiveness shows there are still barriers to optimizing the use of digital channels and still opportunities to optimize all channels through data.

RELATED: Health care consumer engagement: 7 insights from the 2018 RISE/Engagys Survey

Our next survey

The results of this survey reflect the state of engagement before the global pandemic of COVID-19. What’s next?

The unprecedented pandemic has already changed the way the world works when it comes to education, business, and of course health care. As you’ll see below, we’ve tracked consistent trends the last four years when it comes to how companies think about and dedicate resources to consumer engagement. The 2020 survey results will show the first wave of change in our post-pandemic world. We expect to see a major impact on the focus of consumer engagement due to pandemic-related revenue losses, budget cuts and furloughs.

Our fifth State of Consumer Health Engagement Survey will be sent out next month. We encourage your organization to participate, since there has been no time more critical than now to capture this important data.